Top Hidden Fees of Credit Card Processing Pt. 1

Credit card processing can become expensive for your business when your merchant account is not setup correctly. Have you ever looked at your credit card processing statement and noticed “Mid-Qualified” or “Non-Qualified” transactions with a much higher rate than what you originally thought you were paying?

That is one of the most common hidden fees that many merchant services providers use to pad their pockets at your expense. Use this article to determine if your business is overpaying in your credit card processing fees and get some tips for correcting these issues.

“Mid-Qualified” and “Non-Qualified” Transaction Downgrades

If you look at your monthly credit card processing statement, do you see any of the following terms listed on it?

- Qualified or Qual

- Mid-Qualified or MQual

- Non-Qualified or NQual

- NQSF

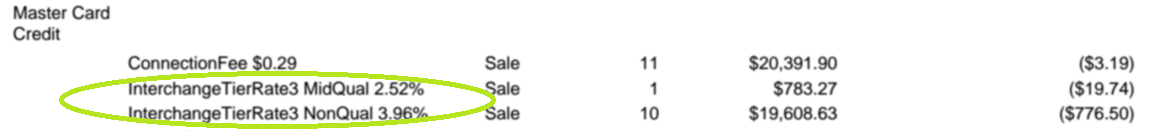

Here is one example of how it may look on your monthly credit card processing statement:

If your answer is YES, this indicates that you are falling victim to one of the most expensive hidden fees / tricks of credit card processing.

Mid- Qualified and Non-Qualified transactions are part of a merchant account pricing model called Tiered-Pricing. With this pricing model your processor will quote you a single low discount rate. This rate only applies to what your processor determines are “Qualified” transactions. However, any transaction that your processor decides is not “Qualified” will automatically be downgraded to a “Mid-Qualified” or “Non-Qualified” pricing tier. These lower pricing tiers carry much higher rates, sometimes 3 to 4 times higher than your ‘Qualified” rate

Another huge issue with Tiered-Pricing is the complete lack of transparency. There is almost no explanation of what makes a transaction downgrade to a lower pricing tier, and your processor can change the qualifications at any time it wants. There is nothing you can do about it, your business is completely at the mercy of your processor.

One very important thing to understand is that the terms “Qualified”, “Mid-Qualified” and “Non-Qualified” are not a classification imposed by Visa, MasterCard, and Discover. These terms are nothing more than “industry lingo” used for describing the different pricing categories within the Tiered-Pricing model.

What can you do about it?

Switch to a Cost-Plus Pricing model immediately! This is the ONLY pricing model that provides true transparency and it's highly cost-effective regardless of the card types you accept. You can learn more about setting up a Cost-Plus merchant account here on our website.

Lost Interchange Credits on Refunds

As a business owner, you have probably processed a refund for a customer at some point in the past. You refund the customer’s purchase price and take back your merchandise. But what happens behind the scenes with the costs for that transaction? If you don’t have a processor that passes along interchange credits, you are paying more than you should.

When your customer paid with their credit card, you were charged to process that transaction. Included in that cost is the interchange fee, or the amount of money that goes to the bank who issued the credit card to your customer. When you refund a transaction, the bank gives a portion of that interchange fee back to your processor, who is supposed to give it back to you. But, many times the processor will just keep it as additional profit for themselves.

If your merchant account is setup on a Tiered Pricing or Bill-Back Pricing model, you are never going to see your interchange credits returned. The lack of transparency makes it very easy for your processor to keep your interchange credits.

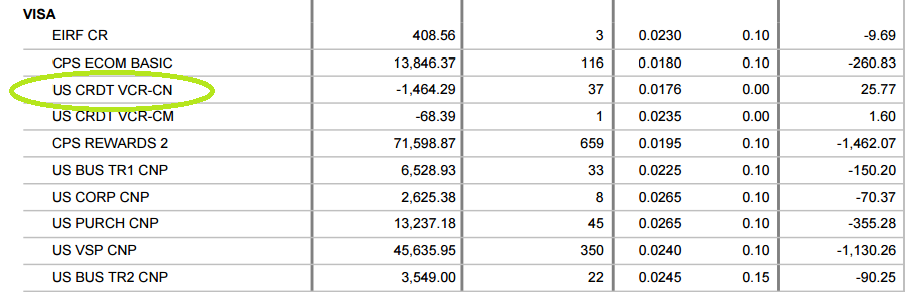

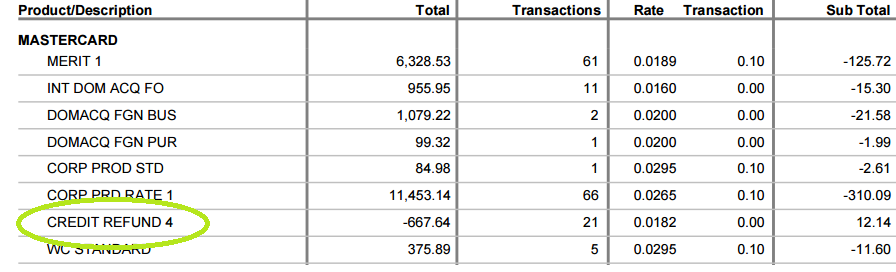

Interchange credits can be listed on your monthly credit card processing statements in a variety of ways.

Here are just a few examples:

If you don’t have time to learn everything about interchange credits and how they are labeled, and you would just like to know if you are getting paid them, we are here to help!

Send us a copy of your recent credit card processing statement and we will prepare a customized rate quote showing how much money your business will save in processing fees by using our service. This quote will breakdown all of your current rates and fees in line item detail and directly compare them ours. We will return your completed rate quote within one business day.

Click Here to complete our free rate quote request form.

Padded Interchange Assessment Fees

Interchange assessment fees are one of the two non-negotiable costs of credit card processing. These are the charges that are set by and paid to the credit card brands --- Visa, MasterCard, and Discover. So how can there be a “hidden” fee if these assessment charges can be found easily online and they are non-negotiable?

Easy: while interchange assessment fees cannot be lowered more than what Visa and MasterCard have set them at… there is absolutely nothing stopping your processor from charging MORE, or “padding” the assessment fees.

One of the largest payment processors in North America, Mercury Payment Systems, has been sued in Federal court twice for this exact type of deceptive pricing. Instead of charging businesses the actual assessment costs, Mercury Payments chose to add a few cents to the assessment fees every time a transaction took place. The result is higher-than-necessary processing costs that are cleverly disguised as non-negotiable legitimate fees. And sadly, they’re not the only ones doing it.

The thing that makes these padded assessment fees more dangerous is the fact that it can be easily done even on an interchange plus pricing model.

What can you do about it?

Work only with a payment processor that offers True Cost-Plus Pricing, meaning that they charge you the actual cost of interchange and assessment fees.

For the past 13 years, Tailored Transactions has been nationally recognized as one of the most reputable merchant services providers in the payments industry.

Contact us today for a no-obligation Free Rate Quote. It takes less than 24 hours to complete. All we need from you is one recent credit card processing statement to review. Let us show you the difference that our customized payment solutions can make to your bottom line!

Visit us online at www.TailoredTransactions.com or call us directly (888) 669.1686